INTRODUCING

iMPACT® | Benchmark Risk Solutions®

Reduce law enforcement loss costs by up to 60%

The Challenge

The Pooling Industry’s First Evidence-Based Risk Management Solution

That’s why Benchmark created iMPACT—a groundbreaking solution deploying evidence-based insights and analytics to empower pools and their members to:

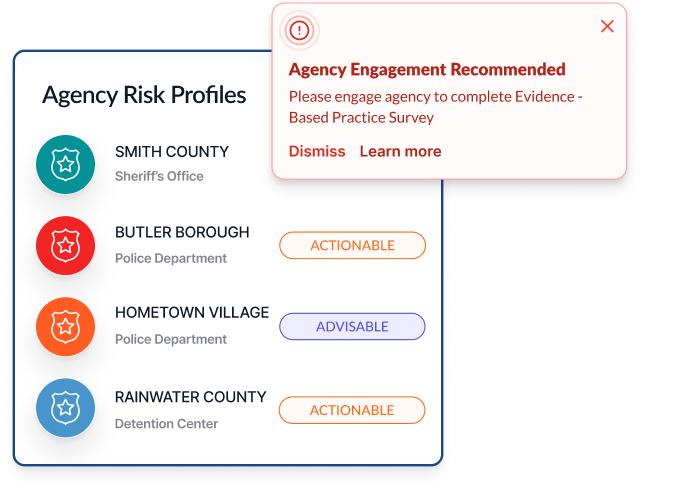

Prevent claims – Forecast future claims likelihood and pinpoint key contributing factors for each member agency.

Drive adoption – Deploy a compelling engagement model proven to inspire agency adoption of risk-reducing practices.

Measure ROI – Identify and statistically measure the effectiveness of loss control activities on agency outcomes over time.

The Benefits of Benchmark’s Evidence-Based Approach

By utilizing iMPACT as part of an evidence-based risk management strategy, risk pools can:

How It Works

The iMPACT solution is a modular set of capabilities from Benchmark and key pool resources, working together to deliver effective risk management. Key steps include:

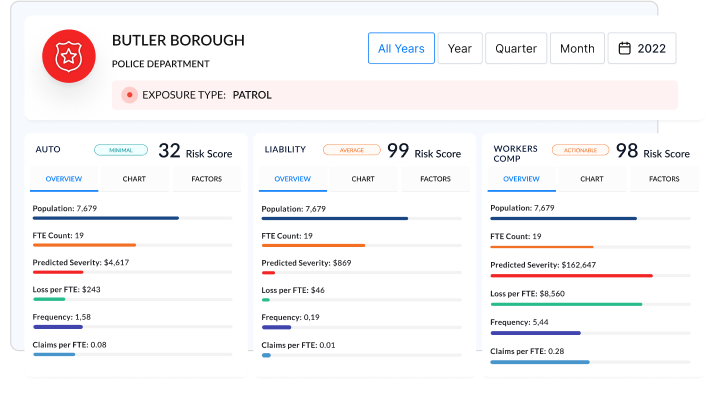

MEASURE AND ANALYZE

MEASURE AND ANALYZE

Define program objectives and establish predictive risk models, evolving with new data and insights.

EVALUATE

EVALUATE

Engage stakeholders to assess specific risks and address key factors like officer turnover, mental health crises, and wellness through evidence-based practices.

MITIGATE AND MONITOR

MITIGATE AND MONITOR

Determine agency risk scores, set program goals and implement tailored loss control interventions, continuously monitoring effectiveness.

Ready to Experience the Benchmark Difference?

Benchmark Analytics and its powerful suite of solutions can help you turn your agency’s challenges into opportunities. Get in touch with our expert team today.